Travel spend that's

ready for accounting

Payments, cost centres, and receipts are handled automatically — so finance doesn’t spend weeks fixing travel data.

Travel spend that's

ready for accounting

Payments, cost centres, and receipts are handled automatically — so finance doesn’t spend weeks fixing travel data.

Travel spend that's

ready for accounting

Payments, cost centres, and receipts are handled automatically — so finance doesn’t spend weeks fixing travel data.

Powered by the world's best

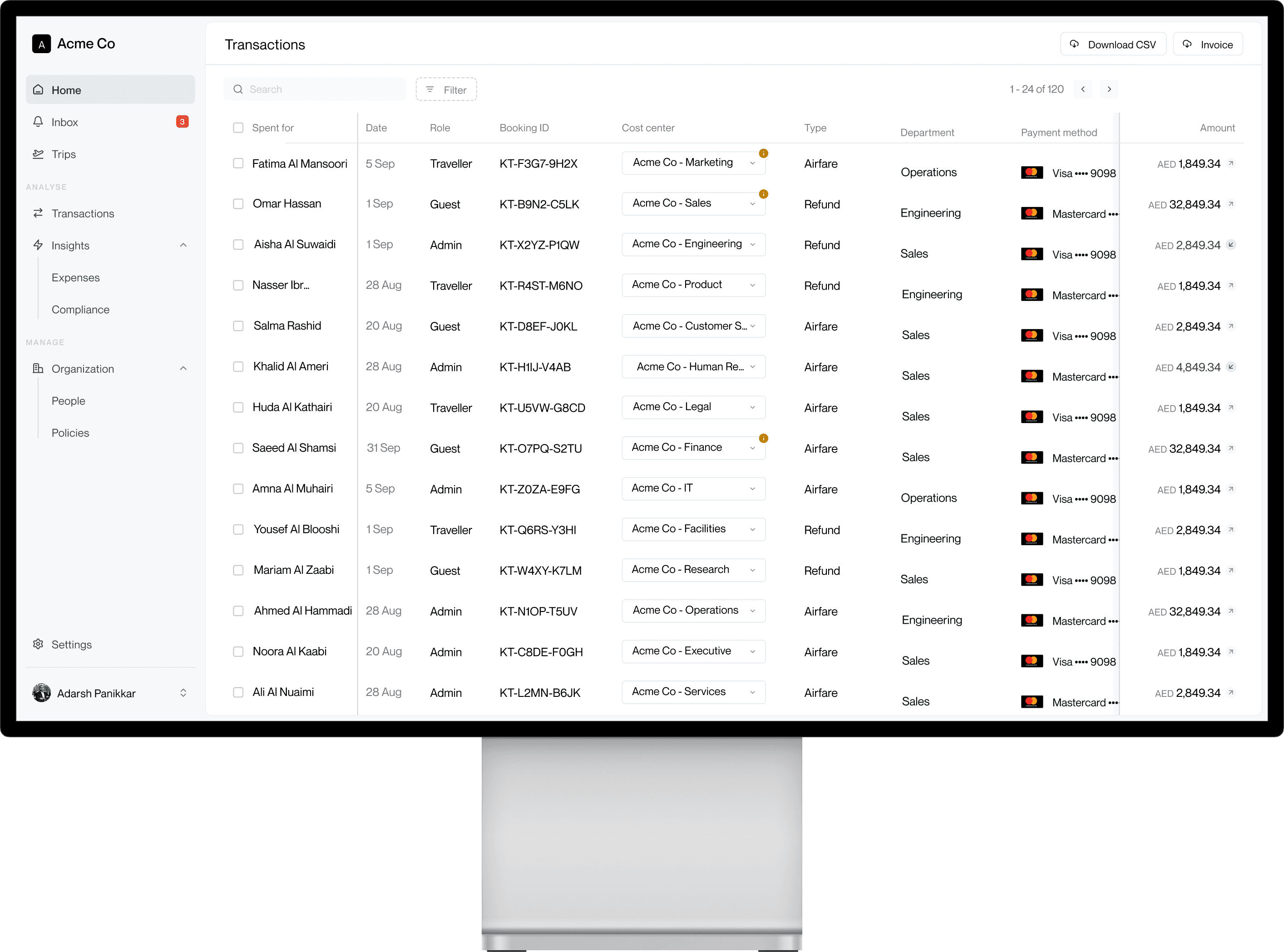

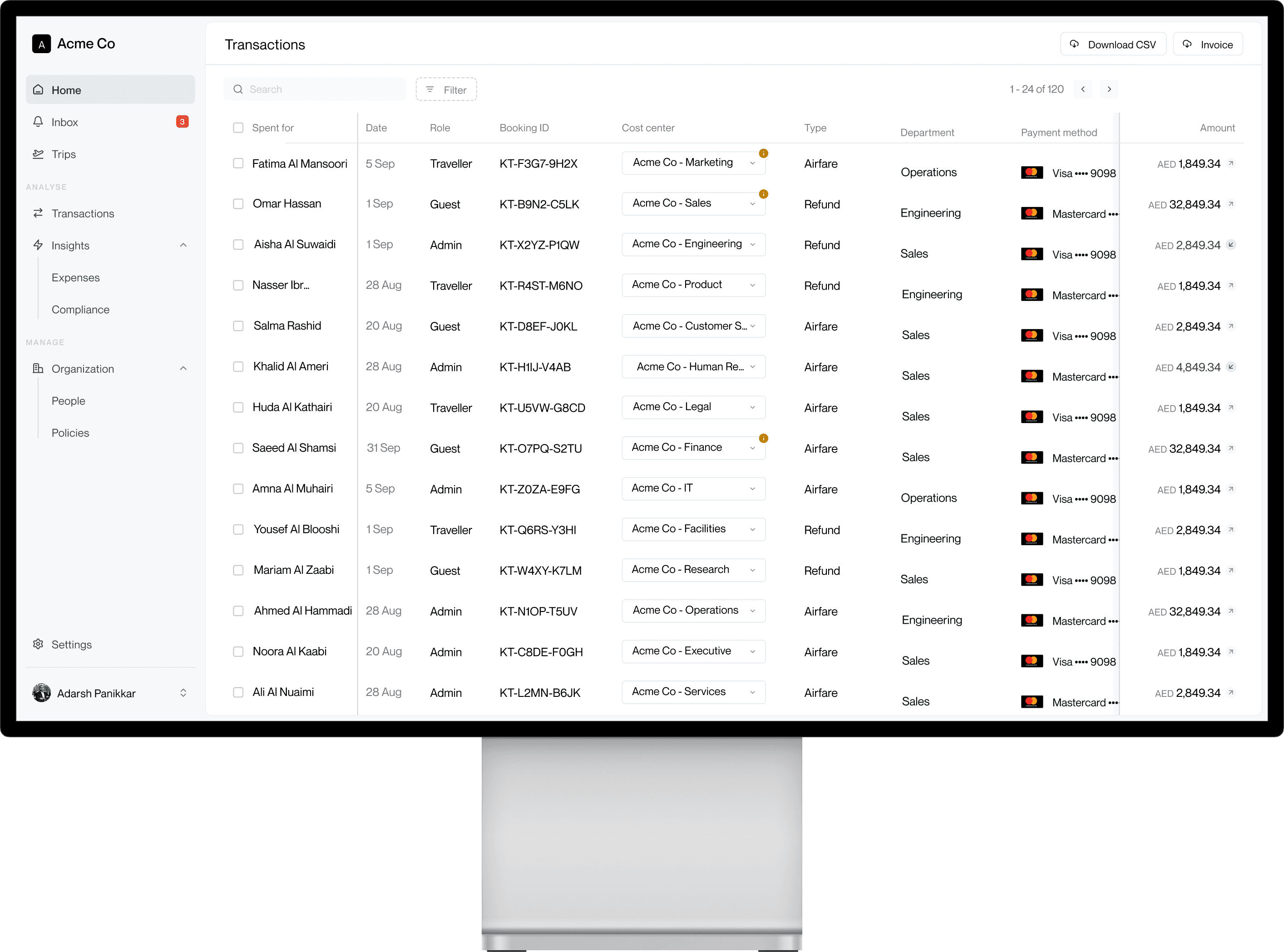

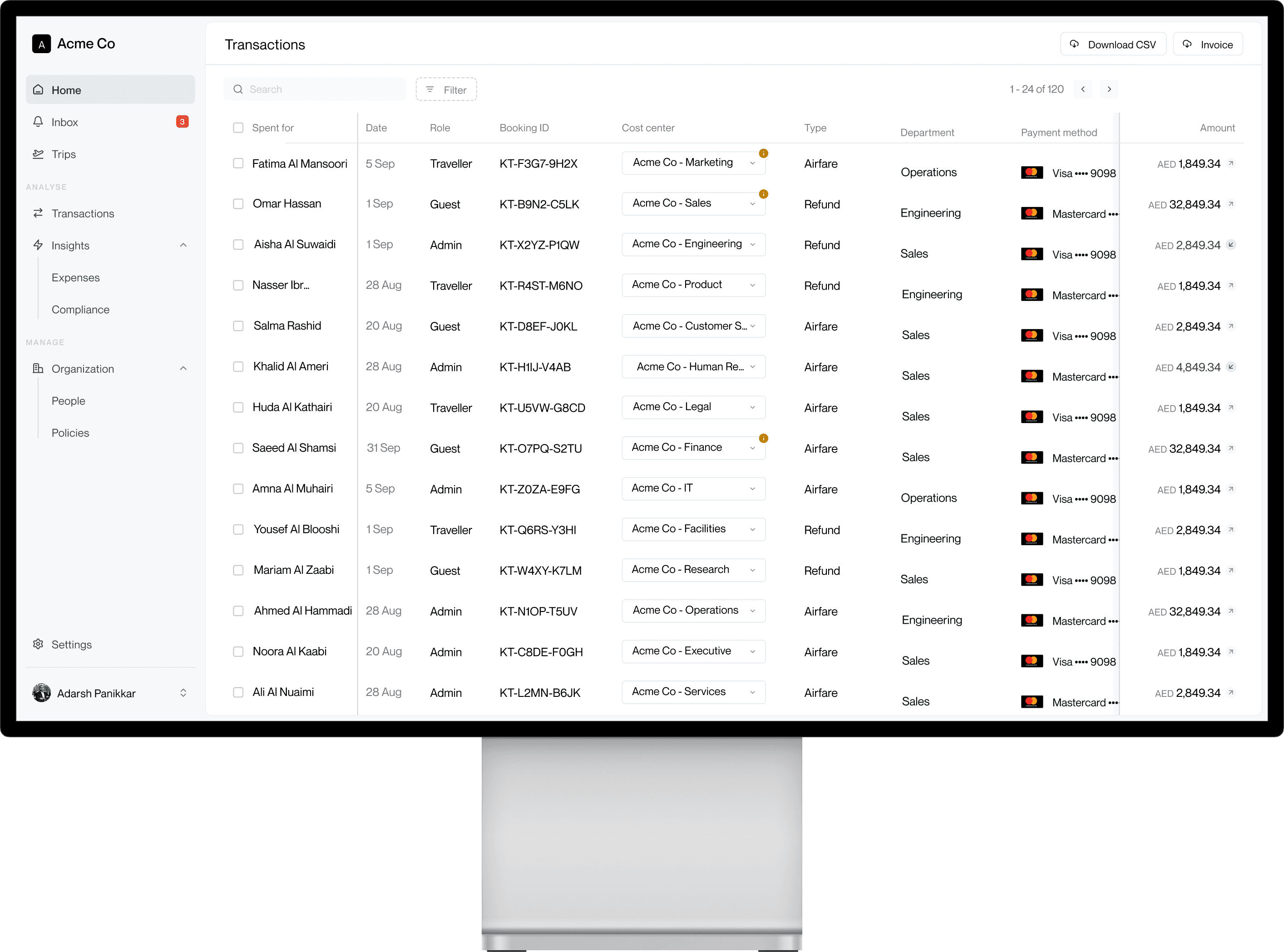

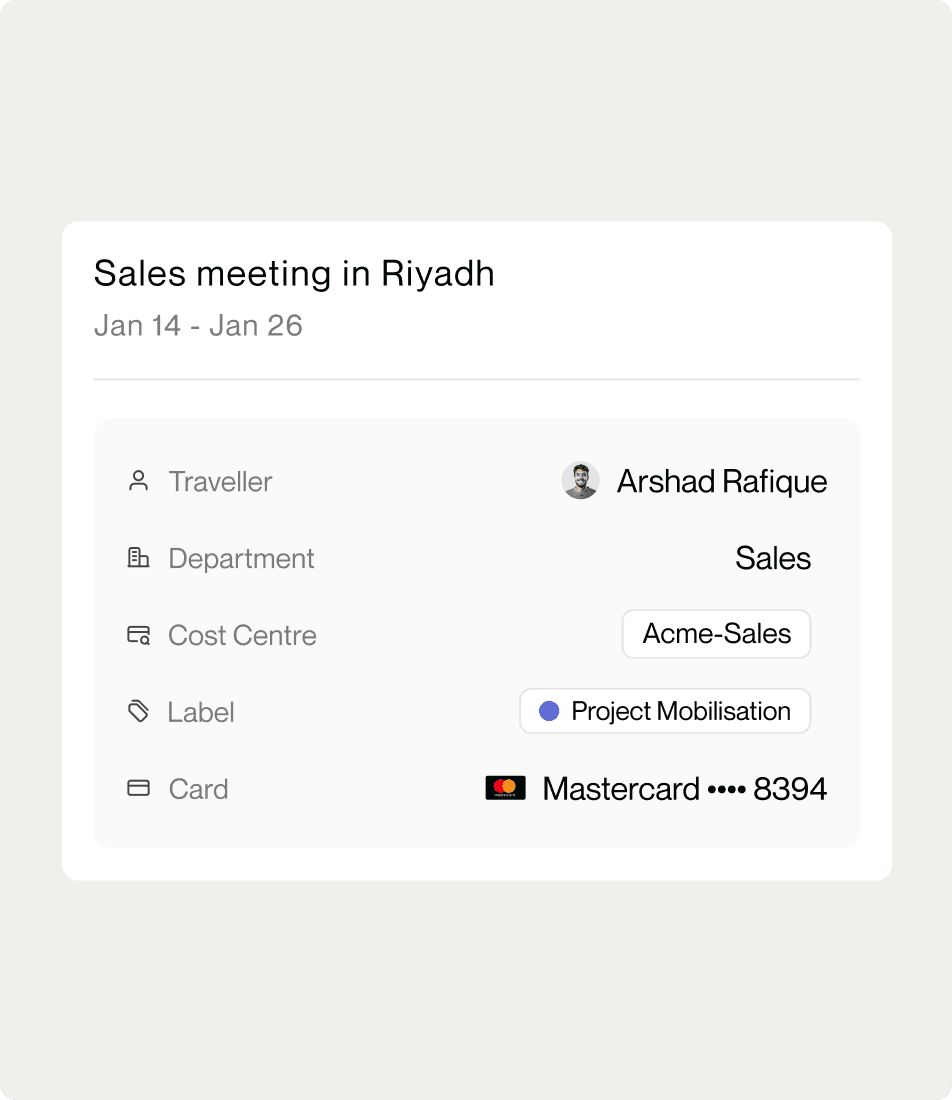

Reconciliation, now solved at booking

Payments hit the right cards, spend maps to the right cost centres, receipts ready instantly

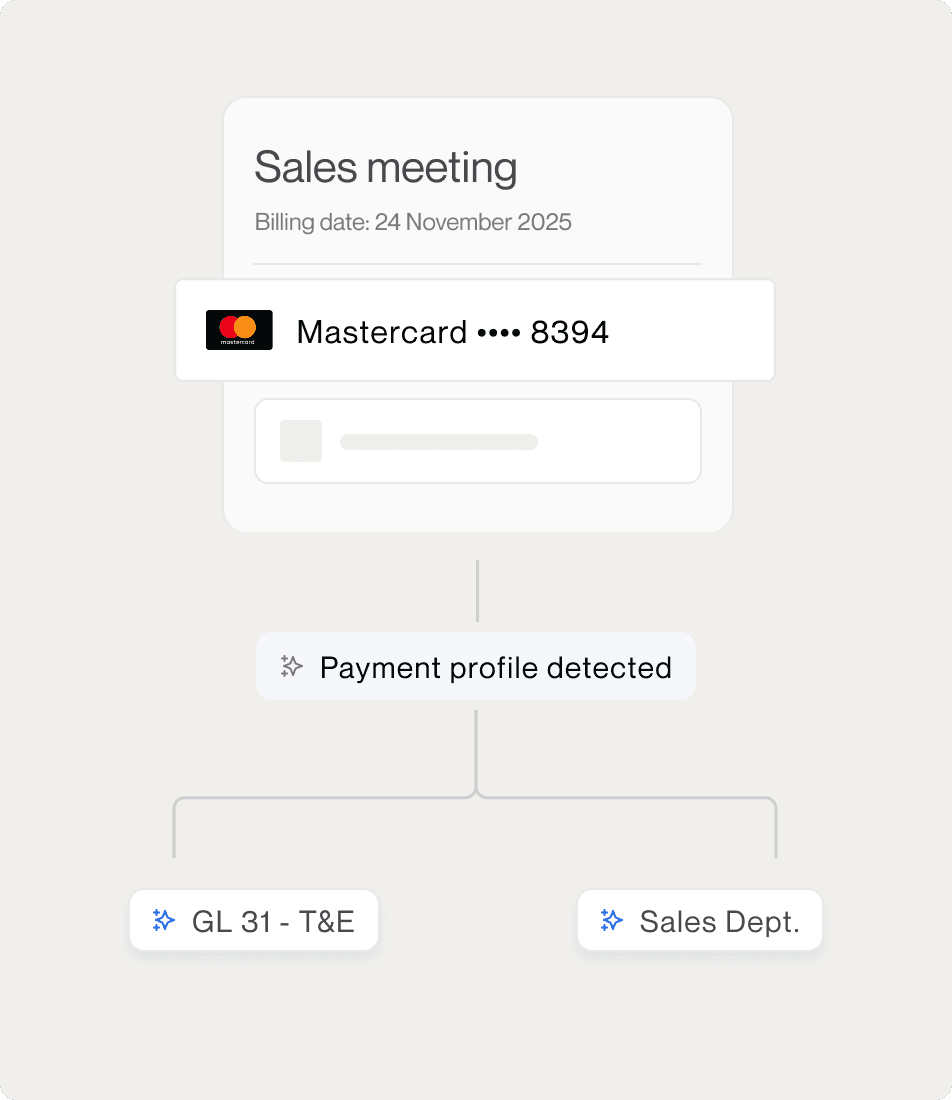

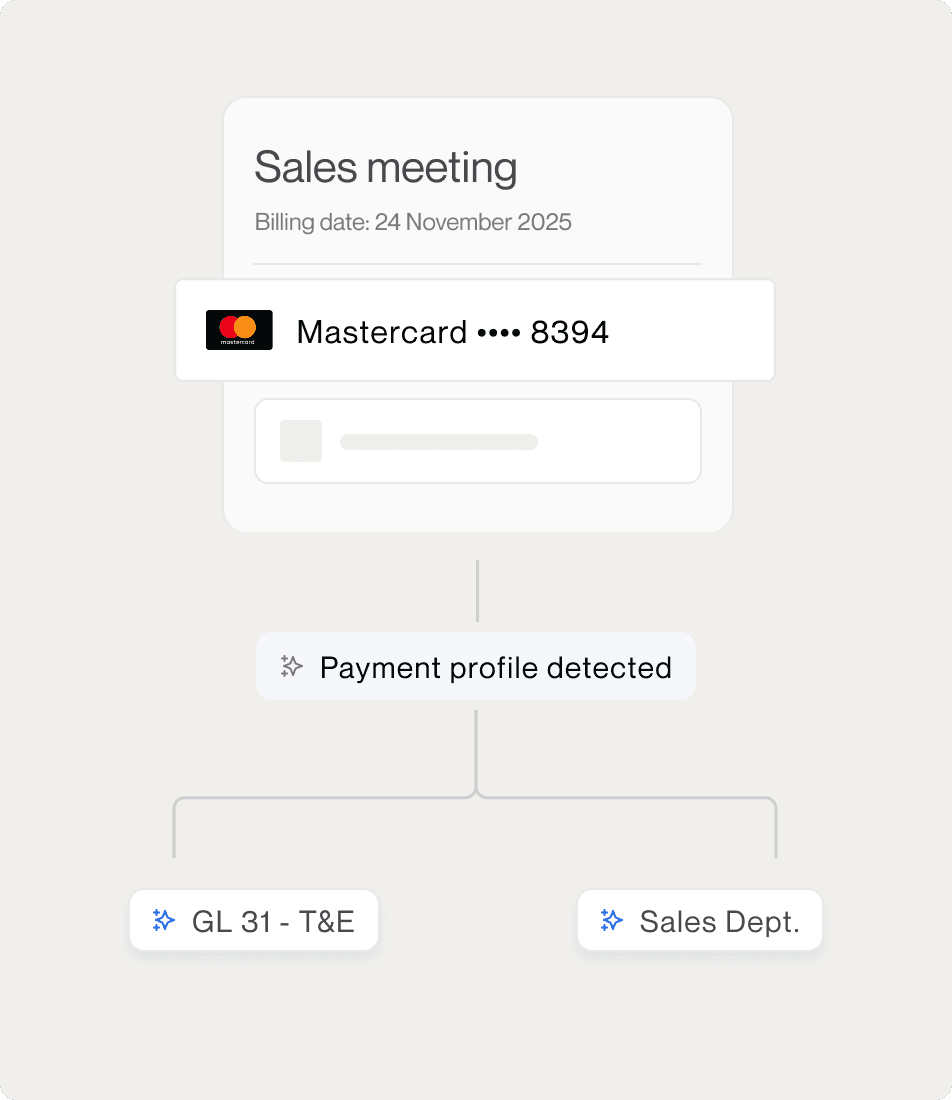

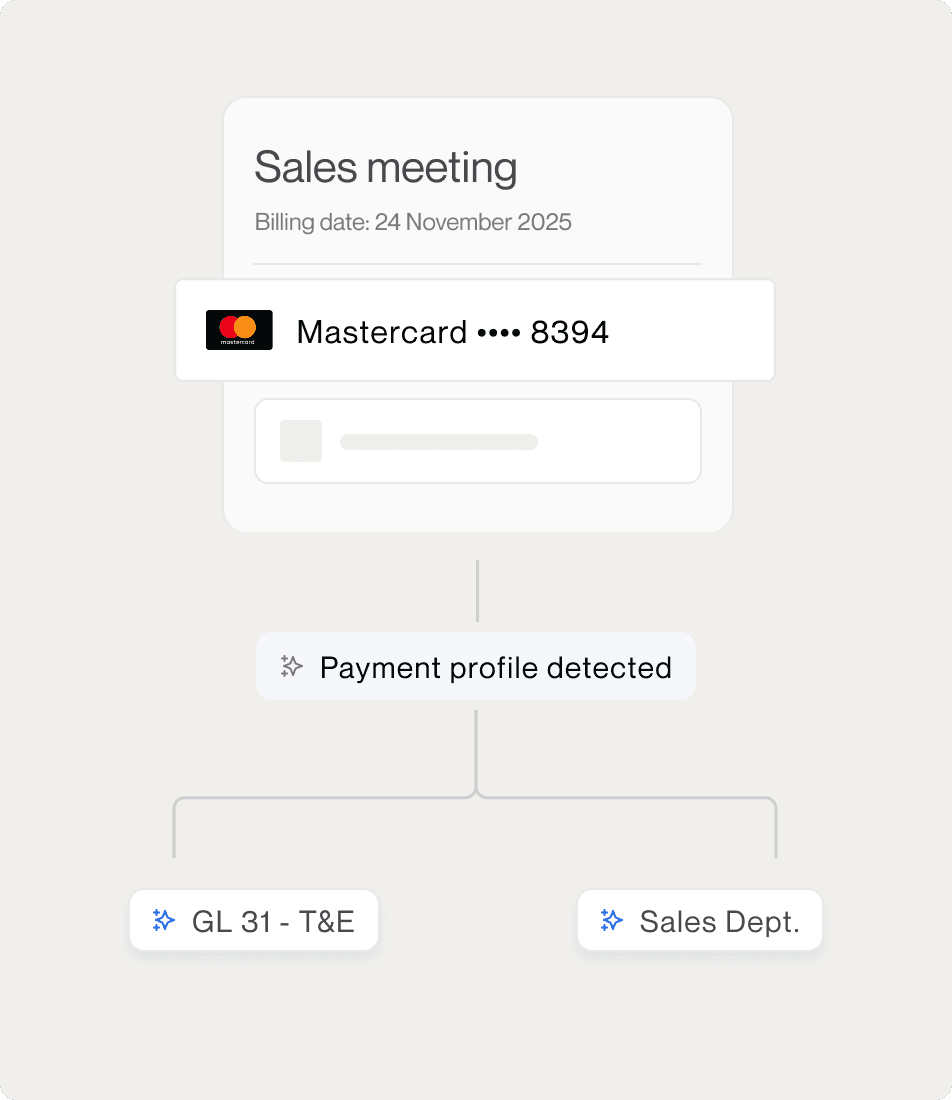

Payment profiles that map to your org

Link cards to departments or cost centres so every trip is charged correctly by default — no reassignment later.

Cost centres that fit your business

Create and manage custom cost centres for teams, projects, or clients, and assign them once — not per booking.

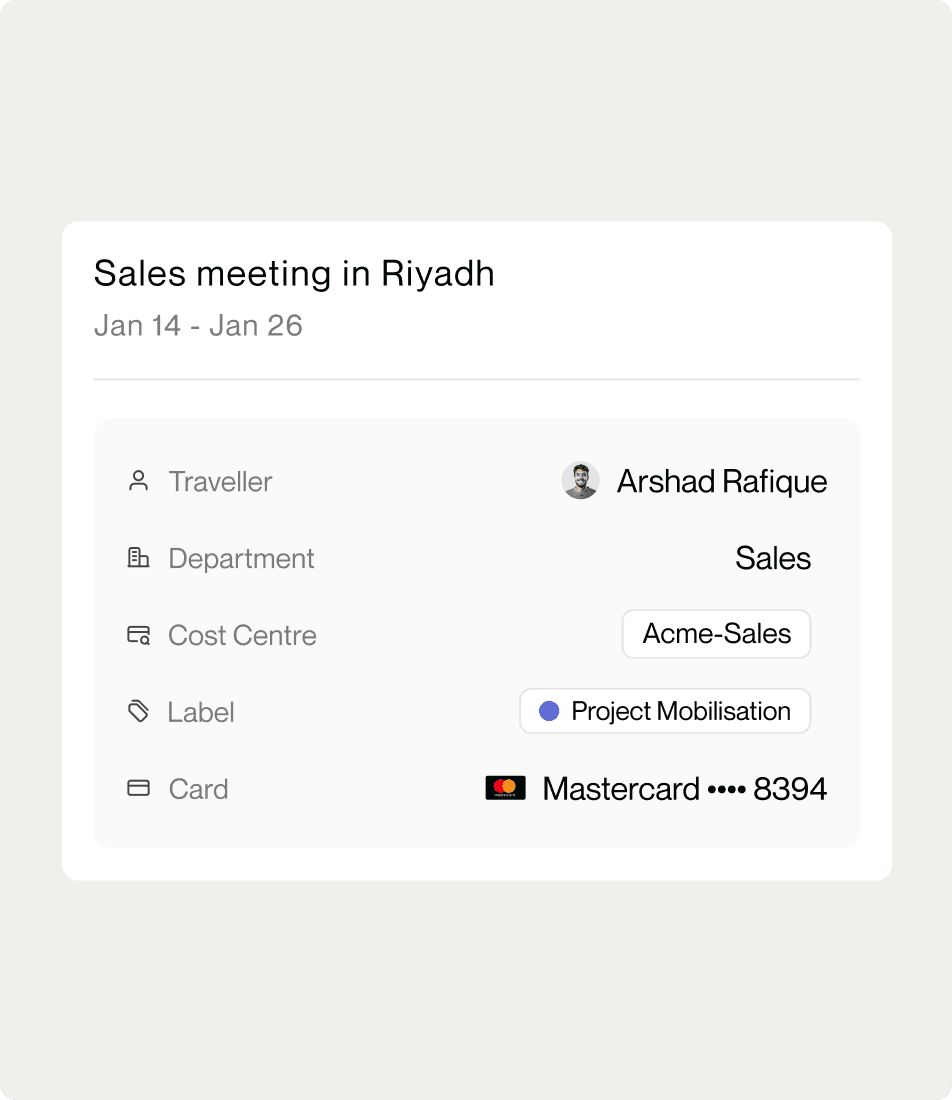

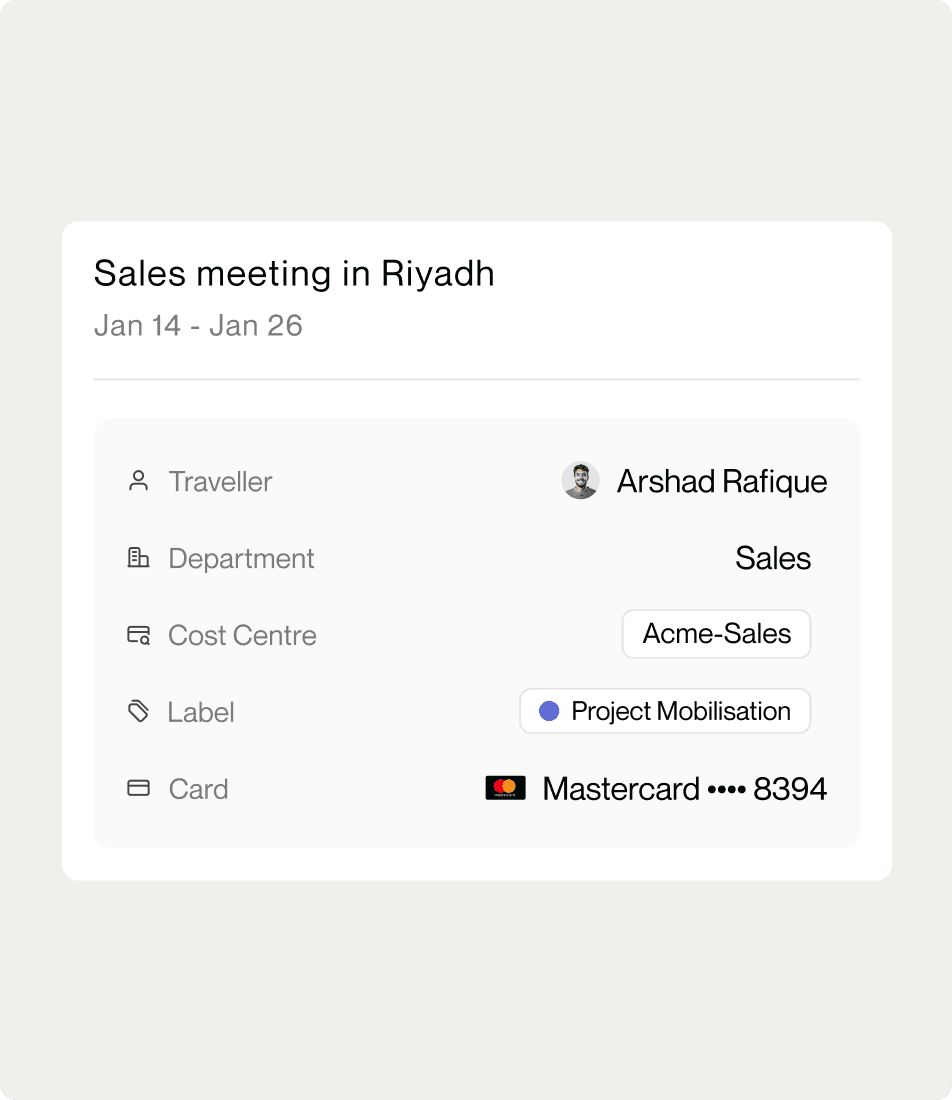

Spend attributed automatically

Trips are linked to the right traveller, card, and cost centre at booking, so reconciliation happens as the trip happens.

Receipts and exports, ready when you are

Instant receipts for every booking, with clean CSV exports for accounting, payroll, or audits.

coming soon

Auto-sync with your existing tools

Travel data flows straight into your ERP, already structured for posting and reconciliation.

Frequently Asked Questions

Frequently Asked Questions

Frequently Asked Questions

How does Kitt eliminate manual expense entry for travel?

Every booking on Kitt automatically creates an accounting entry the moment it's confirmed—with the correct date, amount, traveler name, cost center, and payment method already attached. At month-end, you're not manually entering dozens of transactions from email confirmations or credit card statements. You're reviewing and exporting pre-categorized, pre-reconciled data that's been building throughout the month. What used to take 2-3 days now takes minutes.

What are "payment profiles" and how do they work?

Payment profiles let you link corporate cards to specific departments, teams, or cost centers so every booking charges to the right place automatically. For example: link the "Sales Department Amex" to your Sales cost center, and any employee in Sales who books travel will automatically charge that card with the Sales cost center pre-assigned. No manual reassignment later, no end-of-month cleanup—charges go to the right place from day one.

How does month-end reconciliation work with Kitt?

At month-end, you export all Kitt transactions (direct integrations comin soon!). The data comes pre-structured with: Transaction date and amount Traveler name and employee ID Cost center and GL code Payment method (which card was charged) Booking reference numbers You match these to your credit card statement (Kitt provides transaction IDs for easy matching), review any exceptions, and you're done. Total time: ~10 minutes for 50+ transactions vs. 2-3 days manually categorizing and reconciling.

What accounting systems does Kitt integrate with?

Kitt currently offers CSV export for all major accounting systems (QuickBooks, Xero, NetSuite, SAP, Oracle, Sage, Zoho Books, FreshBooks). Auto-sync ERP integrations are coming soon—when available, travel data will flow directly into your accounting system automatically without manual exports. If you need a custom integration for enterprise ERPs, we can build it.

Can we see travel spend before invoices arrive?

Yes. Unlike traditional travel agencies where invoices arrive 30 days later and surprise you, Kitt shows accrued expenses in real-time the moment bookings are confirmed. You always know your current travel liability—what's been booked but not yet traveled, what's traveled but not yet charged, and what's charged and reconciled. No month-end surprises when the credit card bill arrives. This real-time accrual visibility helps with accurate cash flow forecasting.

What receipts and documentation does Kitt provide?

Every booking generates instant receipts and confirmations: Flights: E-ticket receipt with booking reference, passenger details, fare breakdown, and baggage allowance Hotels: Hotel confirmation with reservation number, nightly rate, total cost, and cancellation policy Cars: Rental agreement with pickup/return details, daily rate, and insurance coverage All receipts are available immediately in the Kitt app and via email, stored permanently in the system, and exportable for audits. You never need to chase employees for missing receipts.

How much time does Kitt save finance teams during month-end close?

Traditional travel expense processing takes 2-3 days per month: collecting receipts from employees, manually entering transactions, categorizing by GL code and cost center, reconciling against credit card statements, and chasing missing approvals or documentation. With Kitt, this drops to minutes: data is pre-categorized and reconciled throughout the month automatically, receipts are attached to every transaction at booking time, cost centers are assigned upfront (no reassignment needed). Finance teams report saving 15-20 hours per month on travel accounting alone—time that can be spent on strategic work instead of data entry.

How does Kitt eliminate manual expense entry for travel?

Every booking on Kitt automatically creates an accounting entry the moment it's confirmed—with the correct date, amount, traveler name, cost center, and payment method already attached. At month-end, you're not manually entering dozens of transactions from email confirmations or credit card statements. You're reviewing and exporting pre-categorized, pre-reconciled data that's been building throughout the month. What used to take 2-3 days now takes minutes.

What are "payment profiles" and how do they work?

Payment profiles let you link corporate cards to specific departments, teams, or cost centers so every booking charges to the right place automatically. For example: link the "Sales Department Amex" to your Sales cost center, and any employee in Sales who books travel will automatically charge that card with the Sales cost center pre-assigned. No manual reassignment later, no end-of-month cleanup—charges go to the right place from day one.

How does month-end reconciliation work with Kitt?

At month-end, you export all Kitt transactions (direct integrations comin soon!). The data comes pre-structured with: Transaction date and amount Traveler name and employee ID Cost center and GL code Payment method (which card was charged) Booking reference numbers You match these to your credit card statement (Kitt provides transaction IDs for easy matching), review any exceptions, and you're done. Total time: ~10 minutes for 50+ transactions vs. 2-3 days manually categorizing and reconciling.

What accounting systems does Kitt integrate with?

Kitt currently offers CSV export for all major accounting systems (QuickBooks, Xero, NetSuite, SAP, Oracle, Sage, Zoho Books, FreshBooks). Auto-sync ERP integrations are coming soon—when available, travel data will flow directly into your accounting system automatically without manual exports. If you need a custom integration for enterprise ERPs, we can build it.

Can we see travel spend before invoices arrive?

Yes. Unlike traditional travel agencies where invoices arrive 30 days later and surprise you, Kitt shows accrued expenses in real-time the moment bookings are confirmed. You always know your current travel liability—what's been booked but not yet traveled, what's traveled but not yet charged, and what's charged and reconciled. No month-end surprises when the credit card bill arrives. This real-time accrual visibility helps with accurate cash flow forecasting.

What receipts and documentation does Kitt provide?

Every booking generates instant receipts and confirmations: Flights: E-ticket receipt with booking reference, passenger details, fare breakdown, and baggage allowance Hotels: Hotel confirmation with reservation number, nightly rate, total cost, and cancellation policy Cars: Rental agreement with pickup/return details, daily rate, and insurance coverage All receipts are available immediately in the Kitt app and via email, stored permanently in the system, and exportable for audits. You never need to chase employees for missing receipts.

How much time does Kitt save finance teams during month-end close?

Traditional travel expense processing takes 2-3 days per month: collecting receipts from employees, manually entering transactions, categorizing by GL code and cost center, reconciling against credit card statements, and chasing missing approvals or documentation. With Kitt, this drops to minutes: data is pre-categorized and reconciled throughout the month automatically, receipts are attached to every transaction at booking time, cost centers are assigned upfront (no reassignment needed). Finance teams report saving 15-20 hours per month on travel accounting alone—time that can be spent on strategic work instead of data entry.

How does Kitt eliminate manual expense entry for travel?

Every booking on Kitt automatically creates an accounting entry the moment it's confirmed—with the correct date, amount, traveler name, cost center, and payment method already attached. At month-end, you're not manually entering dozens of transactions from email confirmations or credit card statements. You're reviewing and exporting pre-categorized, pre-reconciled data that's been building throughout the month. What used to take 2-3 days now takes minutes.

What are "payment profiles" and how do they work?

Payment profiles let you link corporate cards to specific departments, teams, or cost centers so every booking charges to the right place automatically. For example: link the "Sales Department Amex" to your Sales cost center, and any employee in Sales who books travel will automatically charge that card with the Sales cost center pre-assigned. No manual reassignment later, no end-of-month cleanup—charges go to the right place from day one.

How does month-end reconciliation work with Kitt?

At month-end, you export all Kitt transactions (direct integrations comin soon!). The data comes pre-structured with: Transaction date and amount Traveler name and employee ID Cost center and GL code Payment method (which card was charged) Booking reference numbers You match these to your credit card statement (Kitt provides transaction IDs for easy matching), review any exceptions, and you're done. Total time: ~10 minutes for 50+ transactions vs. 2-3 days manually categorizing and reconciling.

What accounting systems does Kitt integrate with?

Kitt currently offers CSV export for all major accounting systems (QuickBooks, Xero, NetSuite, SAP, Oracle, Sage, Zoho Books, FreshBooks). Auto-sync ERP integrations are coming soon—when available, travel data will flow directly into your accounting system automatically without manual exports. If you need a custom integration for enterprise ERPs, we can build it.

Can we see travel spend before invoices arrive?

Yes. Unlike traditional travel agencies where invoices arrive 30 days later and surprise you, Kitt shows accrued expenses in real-time the moment bookings are confirmed. You always know your current travel liability—what's been booked but not yet traveled, what's traveled but not yet charged, and what's charged and reconciled. No month-end surprises when the credit card bill arrives. This real-time accrual visibility helps with accurate cash flow forecasting.

What receipts and documentation does Kitt provide?

Every booking generates instant receipts and confirmations: Flights: E-ticket receipt with booking reference, passenger details, fare breakdown, and baggage allowance Hotels: Hotel confirmation with reservation number, nightly rate, total cost, and cancellation policy Cars: Rental agreement with pickup/return details, daily rate, and insurance coverage All receipts are available immediately in the Kitt app and via email, stored permanently in the system, and exportable for audits. You never need to chase employees for missing receipts.

How much time does Kitt save finance teams during month-end close?

Traditional travel expense processing takes 2-3 days per month: collecting receipts from employees, manually entering transactions, categorizing by GL code and cost center, reconciling against credit card statements, and chasing missing approvals or documentation. With Kitt, this drops to minutes: data is pre-categorized and reconciled throughout the month automatically, receipts are attached to every transaction at booking time, cost centers are assigned upfront (no reassignment needed). Finance teams report saving 15-20 hours per month on travel accounting alone—time that can be spent on strategic work instead of data entry.